Forex Trading For Begginer

Understanding Forex Trading Basics

Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies with the aim of making a profit. It is a decentralized market where currency is traded 24 hours a day, five days a week.

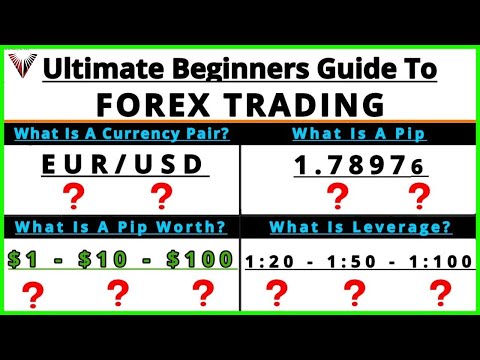

Understanding the basics of Forex trading is crucial for anyone interested in participating in this market. Some of the key concepts to know include currency pairs, bid and ask prices, spread, leverage, and margin.

Additionally, it is important to have a trading strategy and to be familiar with technical and fundamental analysis. By grasping these basic concepts, traders can make informed decisions and manage risk in an attempt to achieve trading success in the dynamic and exciting world of Forex trading.

Explanation Of Key Forex Trading Terms, Including Currency Pairs, Exchange Rates, And Pips

Forex trading involves the exchange of currencies from different countries. In forex trading, currency pairs are used to represent the exchange rate between two currencies. For example, the EUR/USD currency pair represents the exchange rate between the euro and the US dollar.

The exchange rate is the price at which one currency can be exchanged for another currency. The change in exchange rates is measured in pips, which is a unit of measurement for the smallest change in the exchange rate.

For example, if the EUR/USD currency pair moves from 1.1100 to 1.1105, it has moved 5 pips.Understanding key forex trading terms, such as currency pairs, exchange rates, and pips, is important for anyone who wants to be successful in forex trading.

It allows traders to identify profitable trades, develop trading strategies, and manage risk effectively.

Overview Of How The Forex Market Works And How To Read Forex Charts

The foreign exchange market, or Forex for short, is a global marketplace where currencies are traded. Trading in this market involves buying one currency and selling another at the same time. Forex market participants include banks, corporations, hedge funds, individual traders, and governments.

To be successful in Forex trading, it's important to understand currency pairs and their exchange rates. The exchange rate is the value of one currency compared to another currency. It's expressed as a ratio, for example, 1 USD/ 1.

2 EUR, which means that one U.S. dollar equals 1.2 euros.Forex charts are graphical representations of exchange rates over time. There are different types of charts, such as line charts, bar charts, and candlestick charts.

Line charts show the daily exchange rate by plotting a line connecting the closing prices for each day. Bar charts show the high, low, and closing prices for each day, while candlestick charts provide additional information about the trading range and trend direction.

Reading forex charts involves identifying trends, support and resistance levels, and chart patterns. Trend lines connect two or more points on a chart and are used to identify trends. Support and resistance levels are areas where the price typically bounces off or struggles to move beyond.

Chart patterns, such as head and shoulders, triangles, and flags, can provide signals for future price movements.In conclusion, the Forex market is a complex and ever-changing marketplace that requires continuous learning.

Understanding how currency pairs and exchange rates work, and how to read different types of charts, is essential for anyone looking to trade in the Forex market.

Creating A Forex Trading Plan

Creating a Forex trading plan is essential for anyone who wants to become a successful currency trader. A trading plan is a blueprint that outlines how you will approach the market, what your goals are, and what strategies you will use.

A good trading plan should include a detailed analysis of the market, your risk tolerance, as well as your entry and exit points. It should also include details about the type of trades you will make and the amount of money you will risk on each trade.

One of the crucial elements of a trading plan is risk management. To minimize the risks of currency trading, the plan must specify the maximum amount of money you are willing to lose on each trade and how you will exit a trade that is going against you.

The plan should also have contingency measures in case the market behaves differently from what you anticipated. Creating a Forex trading plan takes time and effort, and it is not a one-size-fits-all solution.

It should be tailored to your trading style, level of experience, and objectives. By having a solid trading plan, you can avoid impulsive decisions that may lead to significant losses in the currency markets, and can help you to stay focused on your trading goals and objectives.

Setting Goals For Forex Trading, Including Risk Tolerance And Profit Targets

In forex trading, it is important to set clear goals to guide your decisions and actions. One important aspect to consider when setting these goals is your risk tolerance. Forex trading can be risky, and it's important to know how much risk you're comfortable with before you start.

This will help you determine how much you're willing to lose on a trade, and how aggressive you want to be in your trading strategy. Another important goal to set is a profit target. This is the amount of money you want to make from a trade.

By setting a profit target, you can avoid the temptation to hold onto a winning trade for too long and risk losing your profits. It also helps to keep you focused and motivated. When setting your goals, it's important to be realistic and flexible.

The forex market can be unpredictable, so you may need to adjust your goals and strategies as needed. By setting clear goals that take into account your risk tolerance and profit targets, you can better manage your trading and increase your chances of success.

Developing A System For Analyzing Market Trends And Making Trades

Developing a system for analyzing market trends and making trades is a crucial step in successfully navigating the complex and ever-changing world of finance. To effectively analyze market trends, it is important to gather and analyze data from a variety of sources, such as market reports, competitor information, and consumer trends.

This data can then be used to identify patterns and make informed decisions about when and how to make trades. One effective approach to analyzing market trends is to use big data analytics to identify patterns and trends in market data.

With the large amounts of data available in the financial industry, it can be overwhelming to sort through it all manually. Big data analytics tools enable traders to quickly and easily identify patterns in market data, such as price trends, trading volumes, and market sentiment.

In addition to analyzing market trends, it is important to develop a set of trading rules or algorithms that can be used to make trades. These rules should be based on a thorough analysis of the market and should take into account factors such as risk tolerance, investment goals, and market volatility.

Overall, successfully navigating the world of finance and making profitable trades requires a combination of data analysis, market knowledge, and strategy development. By developing a system for analyzing market trends and making trades, traders can increase their chances of success in this fast-paced and dynamic industry.

Importance Of Discipline And Sticking To The Trading Plan

Discipline and sticking to a trading plan are crucial elements for successful trading. Establishing a well-defined trading plan, which includes clear entry and exit points, risk management strategies, and guidelines for managing emotions, can help traders navigate the often-volatile financial markets.

However, it is equally crucial for traders to have the discipline to stick to their trading plan, even during periods of uncertainty or volatility. This discipline can help traders avoid impulsive decisions that can lead to significant losses.

Maintaining a disciplined approach to trading also requires continuous learning, monitoring and adjusting the trading plan as needed based on market conditions, and acknowledging and learning from mistakes.

Ultimately, discipline and adherence to a well-defined trading plan can lead to greater consistency in trading decisions and increased profitability over the long run.

Choosing A Forex Broker

Choosing a Forex broker is a crucial decision for anyone interested in trading currencies. With so many options available in the market, it can be overwhelming to pick the right one that meets your needs.

Firstly, it is important to find a licensed and regulated Forex broker to ensure that your funds are safe and your trades are executed fairly. Look for brokers that are registered with reputable regulatory bodies such as the CFTC in the United States, FCA in the UK, ASIC in Australia or CySEC in Cyprus.

Secondly, consider the trading platforms that the broker offers. A good trading platform should not only be user-friendly, but it should also have a wide range of tools and features that can help you to analyze the markets and execute trades efficiently.

Thirdly, look at the costs associated with trading with the broker, including spreads, commissions, and overnight fees. Choose a broker with competitive pricing that aligns with your budget and trading style.

Finally, consider the customer service and support offered by the broker. It is important to choose a broker that provides reliable and efficient customer support to assist you when you encounter problems or have questions about your account.

Overall, choosing a Forex broker shouldn't be taken lightly and requires thorough research to find a suitable and trustworthy broker that meets your needs.

Factors To Consider When Choosing A Forex Broker, Including Regulation, Fees, And Trading Platform

When choosing a forex broker, there are several factors you need to consider in order to make an informed decision. One of the most important factors is regulation. It's important to choose a broker who is regulated by a reputable financial authority, as this ensures that they are operating within the bounds of the law and that your funds are being held securely.

Another important factor to consider is fees. Forex brokers make money by charging either a commission or a spread on each trade, and these fees can vary widely between brokers. You'll want to choose a broker who offers competitive fees that won't eat into your profits too much.

Finally, you should consider the trading platform that the broker offers. A good trading platform should be easy to use, reliable, and have all the features you need to make informed trading decisions.

Some platforms are more customizable than others, so you'll want to choose one that suits your individual needs and preferences. By considering all of these factors, you can find a forex broker that meets your needs and helps you achieve your trading goals.

Steps To Take To Ensure The Broker Is Reputable And Trustworthy

When it comes to choosing a broker, it's important to take steps to ensure that they are reputable and trustworthy. After all, you'll be entrusting them with your finances, and you want to be sure that your money is in good hands.

Here are some steps that you can take to ensure that you are working with a reputable and trustworthy broker:1. Research the broker: Before you start working with a broker, take some time to research them and their company.

Look for reviews from other clients, check their track record, and look for any red flags.2. Verify their registration: Brokers and their firms must be registered with securities regulators in the country where they do business.

You can check with the regulator to see if the broker is registered and whether they have any disciplinary actions against them.3. Look for transparency: A reputable broker should be transparent about their fees and charges, as well as their investment strategies.

Ask questions if you're unsure about anything and make sure you understand what you are investing in.4. Check for professional designations: Look for brokers who have professional designations, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

These designations indicate that the broker has met certain stKamurds and has demonstrated expertise in their field.5. Trust your instincts: Ultimately, you need to trust your instincts when it comes to choosing a broker.

If something feels off or if you're not comfortable with the broker, it's best to look elsewhere.By taking these steps, you can help ensure that you are working with a reputable and trustworthy broker who will actively work to help you achieve your investment goals.

Conclusion

Forex trading can be a great way to make money, but it can also be daunting for beginners. That's why it's important to understand the basics before you get started. In this article, we have covered some of the key concepts you need to know to get started with forex trading.

We have discussed topics such as currency pairs, leverage, and margin, and explained how they work in the context of forex trading. We have also provided some tips for beginners to help you get started on the right foot.

Remember, forex trading is a complex and risky endeavor, but if you take the time to learn the fundamentals and practice good risk management, you can have a successful trading career.

Posting Komentar untuk " Forex Trading For Begginer"